overseas income assessment form - hmrc form sa 106 : 2024-10-31 overseas income assessment form Use supplementary pages SA106 to record foreign income and gains on your SA100 Tax Return. overseas income assessment formPortrait of Rabbi Akiba Eger (Eisenstadt 1761 - Poznan 1837) - The Edythe Griffinger Portal. https://www.lbi.org/griffinger/record/248569. Biographical/Historical Information. Akiva .

May 27, 2024 - Entire rental unit for $358. Located 50 meters from Via de 'Tornabuoni, 500 meters from Piazza del Duomo and 600 meters from the Santa Maria Novella train station, the apartmen.

overseas income assessment form We use the “overseas repayment threshold for Plan 1” table to calculate your repayment amount, by using the following steps: We’ll convert your gross annual salary .

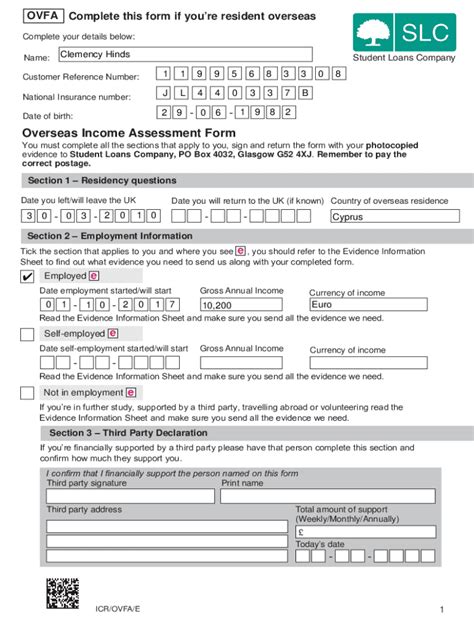

Their contact details and an online form can be found on GOV.UK. The SLC will then take over the collection of the repayments. If you secure employment abroad . If you’re planning on crossing the border for more than three months, it’s essential you inform the SLC and complete an overseas income assessment form .

overseas income assessment formoverseas income assessment formIn their online account, customers can meet their repayment obligations by completing and submitting an annual Overseas Income Assessment Form. Overseas customers are .Completing the Overseas Income Assessment Form. Completing an Overseas Income Assessment Form allows you to provide details of your circumstances and prospective income. When completing the form, remember: to specify the currency of any earned/unearned income; to send evidence that shows the Student Loans Company .You may need to pay UK Income Tax on your foreign income, such as:. wages if you work abroad; foreign investment income, for example dividends and savings interest; rental income on overseas property

Weather forecast, local to international. World class weather radar plus your up to the minute weather report and current conditions. Stay up-to-date with the most reliable 7-day forecast of Malta. Weather conditions, temperatures, wind force and .

overseas income assessment form